Things about Transaction Advisory Services

Wiki Article

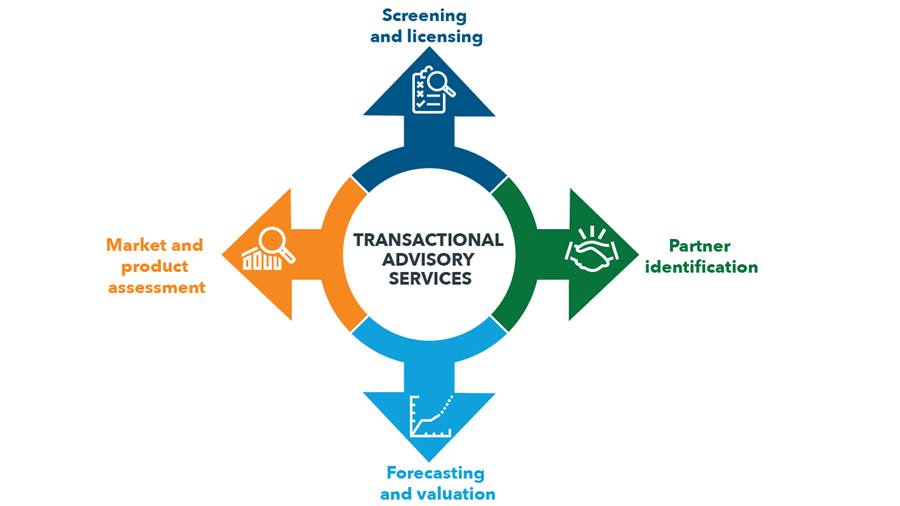

More About Transaction Advisory Services

Table of ContentsNot known Facts About Transaction Advisory ServicesGetting My Transaction Advisory Services To WorkTransaction Advisory Services Things To Know Before You BuyFacts About Transaction Advisory Services UncoveredOur Transaction Advisory Services Ideas

This step ensures the organization looks its ideal to prospective buyers. Obtaining the company's worth right is critical for a successful sale. Advisors use various techniques, like reduced capital (DCF) evaluation, contrasting with comparable business, and recent purchases, to find out the reasonable market price. This aids set a fair rate and negotiate effectively with future buyers.Transaction consultants action in to help by getting all the needed information arranged, addressing concerns from buyers, and setting up check outs to the business's place. This builds trust fund with buyers and maintains the sale relocating along. Obtaining the best terms is crucial. Purchase experts use their expertise to aid entrepreneur take care of tough negotiations, satisfy purchaser assumptions, and framework deals that match the proprietor's goals.

Satisfying lawful guidelines is critical in any company sale. They aid company proprietors in preparing for their next steps, whether it's retired life, beginning a brand-new endeavor, or managing their newfound wide range.

Transaction experts bring a wealth of experience and expertise, ensuring that every aspect of the sale is dealt with professionally. Through critical preparation, appraisal, and settlement, TAS assists business owners attain the greatest possible price. By ensuring lawful and regulative conformity and managing due persistance together with various other offer staff member, purchase consultants reduce prospective dangers and obligations.

The 2-Minute Rule for Transaction Advisory Services

By contrast, Large 4 TS groups: Service (e.g., when a prospective purchaser is conducting due persistance, or when an offer is shutting and the buyer needs to integrate the company and re-value the vendor's Equilibrium Sheet). Are with fees that are not connected to the bargain shutting successfully. Earn fees per engagement someplace in the, which is much less than what financial investment banks gain even on "tiny bargains" (yet the collection possibility is also much higher).

, but they'll focus much more on audit and evaluation and less on subjects like LBO modeling., and "accountant only" subjects like trial balances and exactly how to stroll via occasions utilizing debits and credit reports instead than financial statement changes.

Transaction Advisory Services Things To Know Before You Get This

Specialists in the TS/ FDD teams may also interview administration about everything above, and they'll compose a thorough report with their findings at the end of the procedure.The power structure in Purchase Providers differs a little bit from the ones in financial investment financial and private equity occupations, and the basic shape looks like this: The entry-level duty, where you do a great deal of information and economic evaluation (2 years for a promotion from here). The next level up; similar job, however you obtain the more fascinating little bits (3 years for a promo).

In particular, it's hard to obtain promoted beyond the Manager degree because few individuals leave the work at that phase, and you require to begin showing evidence of your ability to produce profits to breakthrough. Let's start with the hours and way of living considering that those are simpler to define:. There are periodic late evenings and weekend break job, but nothing like the frantic nature of investment financial.

There are cost-of-living changes, so expect reduced compensation if you're in a less expensive location outside major financial (Transaction Advisory Services). For all positions other than Companion, the base pay makes up the bulk of the overall compensation; the year-end reward could be a max of 30% of your base pay. Frequently, the best means to increase your revenues is to change to a various firm and discuss for a higher wage and bonus

Not known Incorrect Statements About Transaction Advisory Services

You could enter business advancement, yet investment financial obtains more challenging at this stage since you'll be over-qualified for Analyst duties. Business finance is still an option. At this stage, you must just stay and make a run for a Partner-level role. If this hyperlink you intend to leave, possibly relocate to a customer and do their appraisals and due diligence in-house.The main issue is that because: You usually need to join another Big 4 team, such as audit, and work there for a few years and afterwards relocate right into TS, job there for a couple of years and after that relocate right into IB. And there's still no guarantee of winning this IB role because it depends upon your region, clients, and the working with market at the time.

Longer-term, there is also some threat of and due to the go to these guys fact that assessing a business's historical economic info is not exactly rocket scientific research. Yes, human beings will certainly always require to be included, however with even more advanced technology, reduced head counts might potentially sustain customer involvements. That stated, the Deal Solutions group beats audit in regards to pay, work, and departure chances.

If you liked this article, you may be thinking about reading.

All About Transaction Advisory Services

Establish sophisticated financial structures that aid in identifying the actual market value of a firm. Provide advisory operate in connection to service appraisal to assist in bargaining and rates structures. Clarify one of the most appropriate type of the bargain and the sort of consideration to employ (money, supply, gain out, and others).

Carry out integration planning to determine the process, system, and organizational modifications that may be called for after the offer. Set guidelines for incorporating divisions, modern technologies, and organization processes.

Determine prospective decreases by minimizing DPO, DIO, and DSO. Analyze the potential client base, sector verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due persistance uses essential understandings into the functioning of the company to be acquired worrying threat evaluation and value development. Determine temporary adjustments to financial resources, banks, and systems.

Report this wiki page